News

BOG 20 Years

December 17, 2025

Board of Governors’ Associate Degree Program Celebrates 20 Years of Expanding Access to Higher Education in West Virginia

Logan, W.Va. – Southern Wes…

Read More

New CAO

December 17, 2025

Southern West Virginia Community & Technical College Appoints Kristi Dixon as Interim Chief Academic Officer and Provost

Southern West Virginia Commu…

Read More

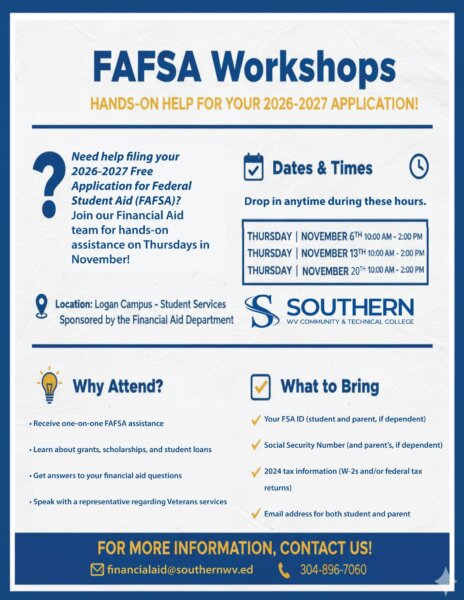

Southern to Host FAFSA Workshops Throughout November

November 20, 2025

LOGAN, WV – Southern West Virginia Community and Technical College’s Financial Aid Department will host a series of FAFSA Workshops in November to he…

Read More

Southern West Virginia Community and Technical College Offering Free FAFSA Assistance

November 17, 2025

Logan, WV — Southern West Virginia Community and Technical College is offering free, hands-on assistance with completing the 2026–2027 Free Applicati…

Read More

Southern West Virginia Community and Technical College Announces Open Spring Registration

November 17, 2025

Logan, WV — Southern West Virginia Community and Technical College is now accepting registrations for the Spring 2026 semester. Students are encourag…

Read More

Southern now offers free online counselling through BetterMynd

October 28, 2025

Need to talk to someone? Are you struggling? BetterMynd Online Therapy can help.

Southern students can schedule FREE 50-minute online therapy session…

Read More

Southern West Virginia Community & Technical College Surgical Technology Program Earns Continued Accreditation Through 2035

October 13, 2025

Under the direction of Professor Misha Herndon, Program Director (right), and Professor Meloney McRoberts, Clinical Coordinator (left), Southern West…

Read More

Southern WV Community & Technical College named a “2025 Great College to Work For.”

September 22, 2025

Southern West Virginia Community & Technical College is one of the best colleges in the nation to work for, according to the Great Colleges to Work F…

Read More

LINE”WOMAN” Accepts the Challenge of the Program

September 12, 2025

Meet Jenna Baisden, a lineman student at Southern WV Community & Technical College who is blazing a trail for women in a male-dominated field.

Her i…

Read More

Southern Gets a “Closer Look” at Workshop

September 4, 2025

Southern took its 2nd-year SM class to a workshop hosted by the nonprofit LessCancer.org, featuring Caleb Runyon, a SWVCTC NU graduate and currently …

Read More

mySouthern

mySouthern