Southern Recognizes Collegiate Recovery on Logan, Boone, and Williamson Campuses

Every year in April, Collegiate Recovery programs, staff and students come together to recognize collegiate recovery.

It is an opportunity to...

Read More

Southern West Virginia Community and Technical College offers you a fast track to becoming a registered nurse. Get signed up for information on our Non-Traditional Weekend Accelerated Nursing Option.

Allied Health - Thursday, May 2 @ 6 pm.

Nursing - Friday, May 3 @ 6 pm.

Arts & Sciences - Saturday, May 4 @ 10 am.

Professional & Technical - Saturday, May 4 @ 2 pm.

Earn 5 certifications in Information Technology for Free!

As part of the NSF Cyber Security Grant at Southern and in partnership with BridgeValley and University of Charleston you can earn your A+, Net+, Security+, and AWS Cloud Practitioner certifications for free in addition to earning the Security Analyst certification from all three schools.

Fall Classes on Boone Campus

Classes Begin August 19th

Contact Elijah Hooker to register now!

304-307-0702 or log on to SSConnect

Summer & Fall Classes

Apply to Southern and Register for Classes Now!

In light of the FAFSA opening later this year and FAFSA applications not being processed until March, the deadlines for both the WV Higher Education Grant and Promise Scholarship application have been extended to May 1, 2024. Please file the FAFSA as soon as possible to maximize your potential for federal and state financial aid programs!

Every year in April, Collegiate Recovery programs, staff and students come together to recognize collegiate recovery.

It is an opportunity to...

Logan, WV – Southern WV Community & Technical College will release its literary arts magazine, titled STICKS, this month.

The annual...

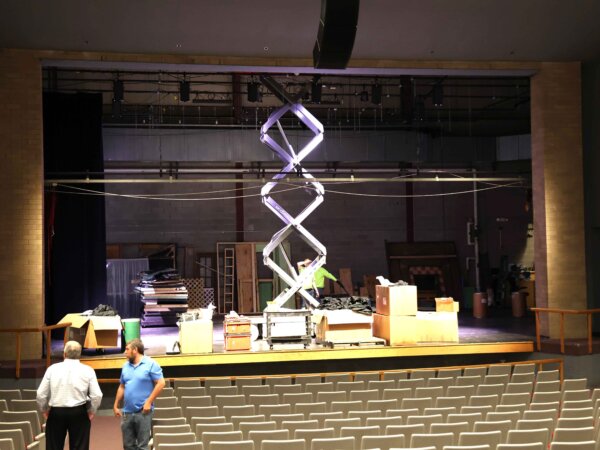

Follow the Yellow Brick Road this summer to Oz!

Auditions will be held for Southern WV Community & Technical College’s summer production of...

Logan, WV – Southern WV Community & Technical College, in partnership with West Logan Christian Academy, is proud to announce a special...

Location

Clearfork Golf Course Oceana, WV

Date

May 11, 2024

9:00am Registration

10:00am Tee Time

Win Prize

Longest Putt

Closest to the...

Southern Academy for Mine Training and Energy Technologies

Former Armory, Williamson

Class starts:

05/13/24

Class Time:

8:00 a.m. to 4:00 p.m.

Cost...

Logan Campus

Building B Room 116

Instructor: Gary Davis

Class starts:

05/20/2024

Class Time:

7:00 a.m. to 5:00 p.m.

Cost is $350

Students will...

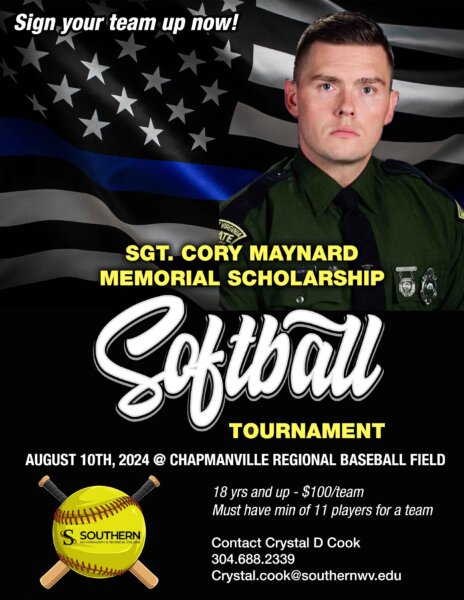

Location

Chapmanville Regional Baseball Field

18 yrs and up – $100

Must have min of 11 players for a team

Date

08/10/24

FOR MORE...

Southern employees will partner with you to accomplish your educational and employment goals. We admire that you consider higher education at Southern to be one of your pathways to success. Our employees are committed to providing high quality education, training, and service to every student who accepts the challenge of earning a higher education at Southern. We are ready NOW! Let’s Get Started! Your success is our business!